Avoid Fraud: Know the Anatomy of Your Credit Card

Credit card fraud is common in the country and there are many ways for thieves to hijack your cards. Unfortunately, there are no accurate ways to know if your card has been hacked, not until the bank statement arrives.

Sometimes, if you are not careful you won’t even notice that your card has already been used by someone without your authorization. And the next thing you know, you are already paying a huge amount of money for something you did not buy.

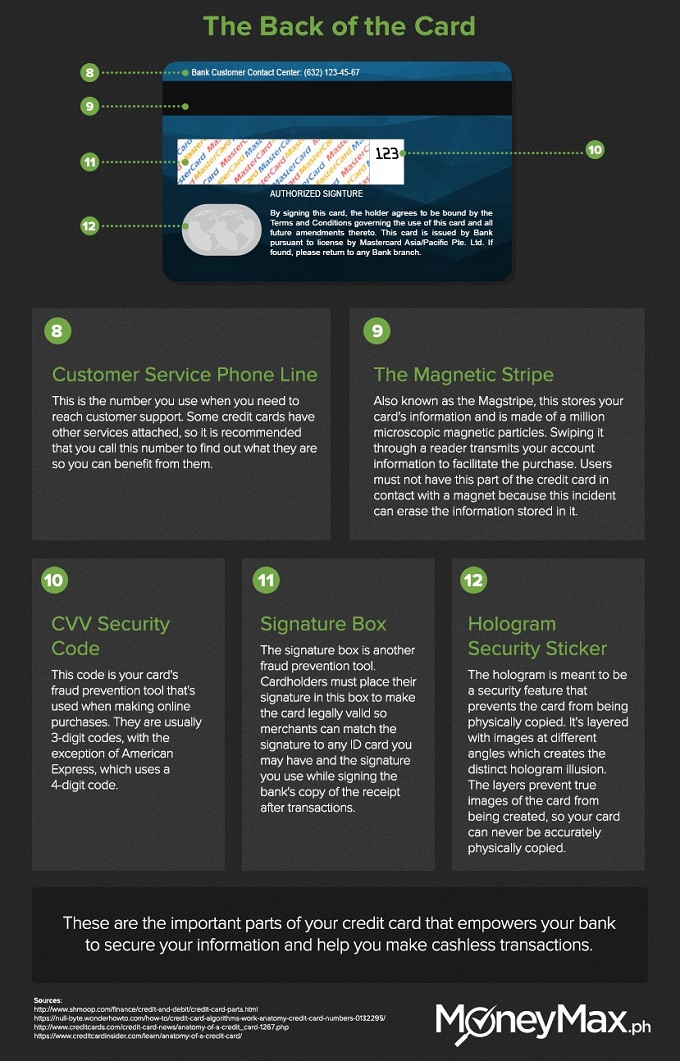

Getting informed is the first step in avoiding Credit card fraud and knowing your card prevents you from becoming a victim. Good thing Money Max PH (moneymax.ph) identified parts of a credit card that Banks use to protect our data. Here is an infographic to help you:

All parts of your card help protect your card from getting hijacked but the most prominent feature is the EMV chip. This is the gold square at the left side of your card. An EMV chip is a stronger security feature compared to a magnetic strip. Every time you shop using an EMV card, it creates a unique code for that transaction. So, if a hacker used that information, he cannot duplicate the card.

Now that you know the parts of your credit card, be sure to be careful when using it. Because despite the numerous security features, there are still plenty of ways for it to be hacked. Being a smart shopper, mindful of where you swipe your card and consistent in checking your transactions also help you avoid being a victim.

With that, who’s ready to go shopping?!

Have you been a victim of credit card fraud? How do you protect your card from getting hacked?

–

Author Bio:

Kyle Kam is from MoneyMax.ph, a financial comparison website aiming to help Filipinos save money through diligent comparisons of financial products.

More From Our Site

A group of young professionals just trying to make the most of their time as millennials in Metro Manila.